Construction was completed in February of a 212,000-square-foot industrial warehouse in Center Pointe Business Park in Urbandale. The project was developed by R&R Realty Group. PHOTO by John Retzlaff

Outlook for industrial development continues to be rosy

BY KATHY A. BOLTEN

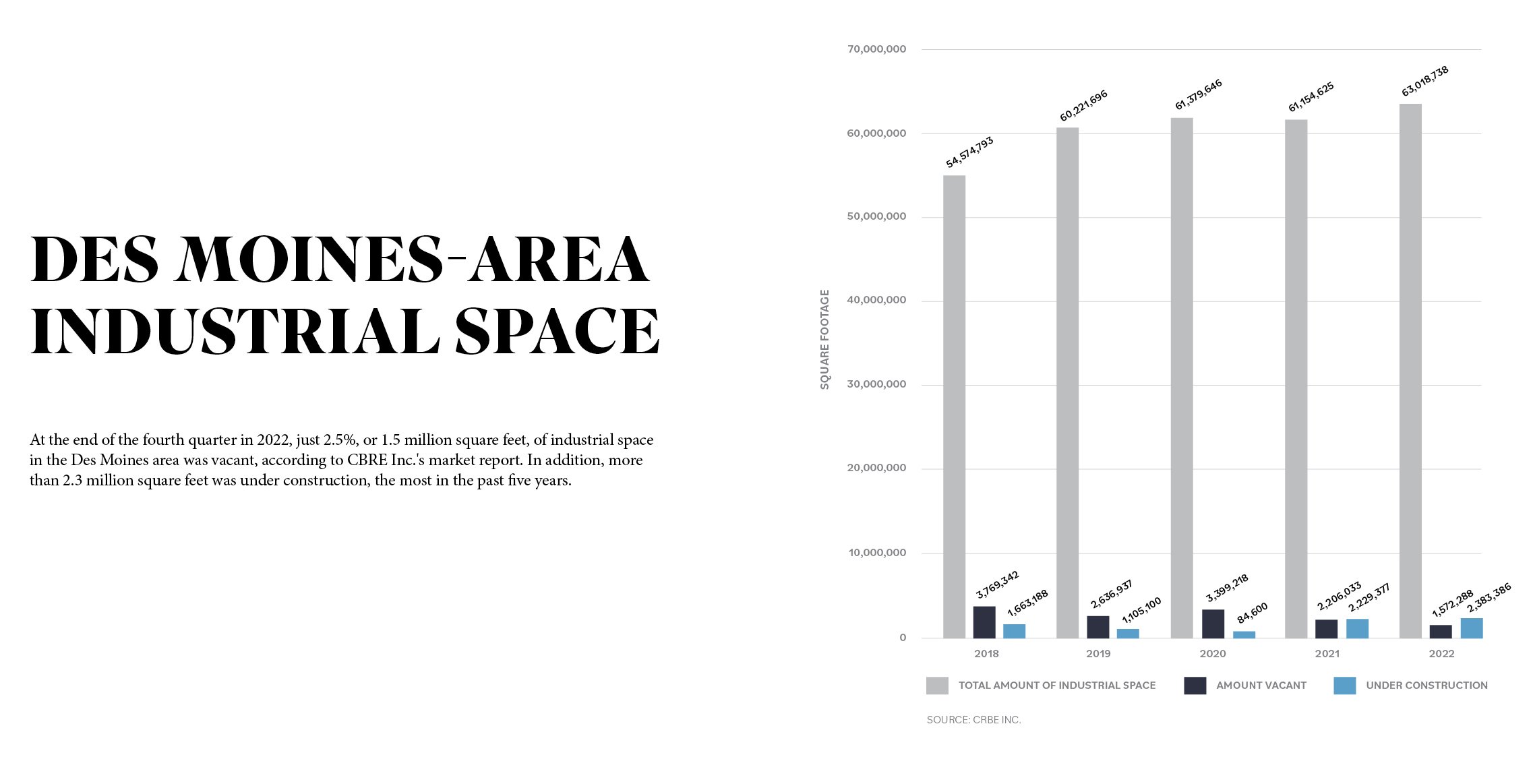

The amount of industrial space in the Greater Des Moines area has grown by more than 8.4 million square feet since 2018, sparked by growth in e-commerce and a change in supply chain logistics that pushed suppliers to move products closer to clients.

A large chunk of the new industrial space has been built in areas in and around Ankeny, Altoona and Bondurant. As ground zoned for industrial use is built out, developers have begun seeking new places on which to build warehouses.

Among the places developers are looking are areas along Interstate Highway 35-80 and near the Iowa Highway 5 and U.S. Highway 65 bypass. An area in Norwalk is also being readied for development for warehouse or manufacturing uses.

“We’ve got a developer moving forward with a project and we could see buildings going up this summer,” said Hollie Zajicek, Norwalk’s economic development director.

Plans for what is being called Dunn Industrial Park include the construction of two 20,000-square-foot speculative buildings, a flyer for the project shows.

In 2022, more than 2 million square feet of new industrial space was built in the Des Moines area, with about 75% of the space, or 1.5 million square feet, pre-leased, according to CBRE’s Des Moines industrial 2022 fourth-quarter report.

In addition, more than 2.3 million square feet of space was under construction in the fourth quarter. Other projects are planned, including the one in Norwalk and one by West Des Moines-based R&R Realty Group. The real estate development group expects to begin construction this spring on a 234,348-square-foot speculative warehouse in its Prairie Tower development in Urbandale. If demand exists, a second warehouse could also be built in the development.

“We have very little vacancy in our existing portfolio, so we see the need to continue to develop and add more products,” said Adam Kaduce, president of R&R Real Estate Advisors, a division of R&R Realty Group.

In late 2022, R&R Realty completed construction of its fourth warehouse in Prairie Business Park in Grimes. The structure was pre-leased, Kaduce said. Construction of a 212,000-square-foot warehouse in Center Pointe Business Park, also in Urbandale, was completed in February.

Construction of the speculative space is being sparked by low vacancy rates in existing industrial spaces. In 2018, 7% of industrial space in the Des Moines area was vacant, according to CBRE’s fourth-quarter market report. During the same period in 2022, just 2.6% of the area’s more than 63 million in industrial space was vacant, according to the report.

The low vacancy rates have prompted a flurry of warehouse construction. At the end of the fourth quarter of 2022, about 2.4 million square feet of space was under construction, the most in a five-year period.

It’s unlikely that construction of industrial space will continue at its current breakneck pace, industry observers say. However, construction is also unlikely to come to a standstill, they say.

“I think we’ll see a natural slowdown as more space comes online,” Kaduce said. “Not all of that space has been leased, so it will take some time to fill it up. As a result, we’ll probably see development slow down to a level that’s more consistent with what we’ve had in the past.”

Ryan Moffatt, an economic development coordinator for the city of Des Moines, offered a similar view: “The developers I talk with are saying that with all of the speculative product that is in the pipeline right now, 2023 could be a slower year in terms of new products that are offered.

“They are also quick to say that could change very quickly,” Moffatt added.

Among the places developers are showing interest in is vacant land near the Iowa Highway 5 and U.S. Highway 65 bypass.

“I think the bypass represents the next succession of where this product type can go, especially if [developers] have clients that might benefit from being in close proximity to the airport,” Moffatt said.

One reason for the increased interest in developing along the bypass is the ability to tap the south-side labor pool, Moffatt said. Amazon’s two facilities in Bondurant have attracted workers, many of whom are likely from the northeast section of Polk County. Occupants of other newly built warehouses also likely live in the northeast part of the county.

“The northeast labor submarket might be getting a little bit worked over,” Moffatt said. Developing warehouses and other projects along the bypass would allow companies to “tap into a different pocket of the labor market and find more employees to work at these facilities.”

Farther south, Norwalk is in the beginning stages of getting a second site certified through the Iowa Economic Development Authority’s decade-old program. Increasingly, company leaders are shortening the time it takes to make decisions about building new facilities. The state site certification program, using national standards, helps communities prepare shovel-ready development sites.

Norwalk officials want about 135 acres in the southwest part of the city designated as a certified site. The area is south of its initial certified site east of Iowa Highway 28 along Delaware Street. The Warren County community’s first certified site includes Michael Foods and Windsor Windows and Doors.

“This would be a game-changer for Norwalk if we could get the site certified,” Zajicek said. Officials have begun planning expansion of the infrastructure in the southwest part of Norwalk that could include extension of a four-lane street to Interstate 35.

Interest already exists in developing a portion of the land. Earlier this year, the Norwalk City Council approved a development agreement with a group that plans to develop about 40 acres on the south side of Delaware Street. The development agreement provides the group with money from tax increment financing to help pay for infrastructure improvements, Zajicek said.

Dunn Industrial Park also had three other lots available to develop.

“These types of projects are good for the community,” Zajicek said. “They are good employers and they attract other projects.”